Explore our NinjaTrader 8

Indicators and Tools

Your membership grants you full access to every tool offered here and MORE - forget piecemeal purchases. Embrace the one-stop, comprehensive NinjaTrader system that will be the last one you'll ever require. Enjoy an exclusive suite of over 60 vetted indicators and automated strategies, distilled to the most effective and reliable essentials.

The DTB Traders System of Products

Introducing the DTB System, a unified toolkit engineered to streamline your trading journey. Say goodbye to the hassles of piecing together solutions from multiple marketing companies and sifting through endless, often ineffective, options. 100’s and 100’s of indicators are not needed to tell you what price is doing, our top 3 do that beautifully, the DTB System dispels the noise of deceptive ‘magic bullet’ indicators. We won’t lure you with hollow promises of earning $1000 a day, because we value honesty over marketing gimmicks.

Chart setup can be a challenge, but not with the DTB System. We equip you with rigorously tested and proven templates, complete with essential indicators. Alongside these templates, we provide lucid, effective training materials to help you capitalize on the market’s potential.

In essence, the DTB System is your comprehensive solution, bundling all the tools you need in a single, cohesive package. No need to look elsewhere — we’ve got you covered.

A core feature of the DTB System is our fully automated strategies. You can customize these to your liking, or if you prefer simplicity, our advanced “Use Auto Optimised Feature” is at your disposal.

This feature ensures your strategy settings stay updated on the active trading chart, keeping pace with the latest configurations and boosting your chances of success.

Imagine having a team of seasoned professionals continually refining your settings based on current market conditions, then applying these improvements directly to your trading chart, sparing you the effort. Keep the strategy active on your trading chart, and it takes care of the rest. No need for you to stop and manually tweak settings. The strategy self-updates, tirelessly aligning you with the most favorable market conditions. Trading is made simpler and more efficient with the DTB System.

At DTB Traders, we take pride in providing top-tier value that respects your budget. No need to spend thousands upfront, or commit to hefty training course fees of $5000 or more. With our “earn as you learn” philosophy, we ensure you get the most bang for your buck.

We firmly believe that the right tools, the right training, and a positive mindset can pave the way to consistent trading success for anyone. And when you’re backed by a community of like-minded individuals, your journey towards profitability becomes a shared adventure.

Remember, you’re not alone in this journey. We’re here to guide and support you every step of the way. With the DTB System, trading success is well within your grasp, and we can’t wait to help you achieve it!

DTB Account Position Indicator

Navigating multiple trading accounts or charts can be complex, but not with our tailored indicator. This simple yet powerful tool provides a real-time summary of your specific trading account, displaying both your unrealized and realized profit and loss, as well as the account balance and name should you choose to view them. Learn more by watching this video: https://youtu.be/Mqsc83D4ns4

Add it on any or all of your charts. For added privacy, especially when sharing screenshots within the Group, we offer an option to hide your account balance and even account name. We understand that every trader’s needs are unique, so we’ve made the box position and colors fully customizable. Adjust the vertical & horizontal offset, and fine-tune the Brush settings to your liking.

You can link the indicator to a specific account of your choice in the settings. If you’re not using the privacy setting, the account name will be displayed in the box for quick reference. Make the most of your trading experience with our custom indicator, designed with both functionality and privacy in mind.

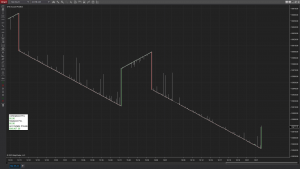

DTB Advanced Retracement Indicator

This indicator is designed to showcase price retracement with precision. While it is most accurate when used on a smaller tick bar type, such as the DTB Bars 10_10, it can also be utilized on bar close for minute/volume bars or other non-specific tick-based bar types.

Incorporated within the Advanced Retracement strategy, this indicator allows for optimization via the Strategy Analyzer. It helps identify the retracement value that has proven effective for any particular instrument over a selected timeframe – be it days, weeks, or months. (Templates are included for your convenience.)

Feel free to load this tool on any or all of your charts. It provides you with a predefined (and adjustable) retracement value that price has retraced. Additionally, you have the option to enable or disable bar painting and modify their colors.

Beyond just providing current retracement markers, the indicator also illustrates where the price is currently trading in relation to it. For a visual cue, it draws triangles on your chart. This indicator is geared towards helping you understand price retracement in a comprehensive yet intuitive manner.

DTB Advanced Retracement Strategy (fully automated)

This strategy comes packed with a wealth of basic and advanced features designed for your convenience. Let’s explore them:

Basic Features:

- On-chart buttons and sliders to adjust settings dynamically, negating the need to stop and restart the strategy.

- Daily Target/Stop in $ to manage risk effectively.

- Trailing Drawdown for additional risk management.

- Customizable Trading Hours/Days to suit your schedule and market preference.

Advanced Features:

- The innovative “Use Auto Optimised Feature” facilitates dynamic optimization of the strategy. This means settings are adjusted automatically and synced with the active strategy on your trading chart. YES, that means settings are AUTOMATICALLY updated when using this feature!

- Up to 10 unique Templates are included, each with custom Instrument and bar types. A comprehensive Document (accessible via strategy settings) provides detailed information to help you choose the right template for your trading session. It is important to review this document regularly, as it is updated WEEKLY. Daily checks are advised to stay abreast of any mid-week updates.

- The option to trade Trend or Reverse adds another layer of flexibility.

- Adjustable settings, such as Retracement value and Trade Size value, can be tweaked while the strategy is active. No need to pause or restart – new entries are executed with updated settings seamlessly.

- The Strategy Analyzer is available for optimal back testing. Use the Strategy Analyzer to optimize this strategy, we ALWAYS include commission and Slippage (unlike the con-artists who exclude these).

- Known for its consistency, our strategy performs exceptionally well when the right settings combination is applied.

- Its ability to modify parameters makes it compatible with all trading instruments providing an integrated, dynamic solution, enhancing your trading performance while ensuring user-friendly operation.

DTB Advanced StrategyLine Strategy (fully automated)

This automated strategy, while sophisticated in its design, is remarkably easy to understand, offering many ways to personalize and adjust to your trading style. Moreover, it is designed to work exceptionally well on the DTB Bars and has been proven effective on Minute bars as well, feel free to experiment with your preferred bar type.

Basic Features:

- On-chart buttons and sliders allow for real-time adjustment of settings.

- Set Daily Targets and Stops in $ to manage your daily trading risk.

- A Trailing Drawdown feature allows for additional risk control.

- Customize your Trading Hours/Days to fit your trading routine.

Advanced Features:

- The innovative “Use Auto Optimised Feature” allows for dynamic strategy optimization, with settings automatically adjusted and synced to the active trading chart. YES, that means settings are AUTOMATICALLY updated when using this feature!

- Up to 10 custom Templates are included, each catering to specific instruments and bar types. A detailed Document (link available inside the strategy settings) guides you in choosing the right Template for your trading session.

- The Document is updated WEEKLY, so daily checks are recommended to stay updated with any changes.

- After setting up the chosen Template, simply activate the strategy and you’re good to go! This entire process typically takes just about a minute.

To make the most of the “Use Auto Optimised Feature”, we recommend reviewing the Document before activating the strategy. The Document outlines the settings controlled by the auto-optimised feature, including Sensitivity value, Confirmation bar settings, Trading Start and End times, Daily Profit and Stop Loss, and more.

While the “Use Auto Optimised Feature” optimizes most settings, you have control over certain parameters. These include the position of strategy buttons, label color background, the use of Trailing Drawdown and its value, the bar size determining Daily Exits, and Trade Size, but this is all explained in the detailed training document for this strategy.

In sum, our strategy offers a seamless blend of automation and customization. The settings you control can enhance your trading experience while maintaining the benefits of automatic adjustments. With just a few simple steps, you can set up your trading day, review the document, select your Template, and start trading! Use the Strategy Analyzer to optimize this strategy, we ALWAYS include commission and Slippage (unlike the con-artists who exclude these).

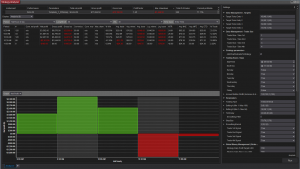

DTB Analytical Strategy 1 (fully automated)

The Analytical Strategies are THE most potent trading strategies available on NinjaTrader and can be applied to various bar types except time-based bars. They are specifically designed to work with the DTB Bars. Trading is conducted from Sunday to Thursday, skipping Friday, and can be optimized for different instruments.

The strategy offer basic features such as chart buttons/sliders for adjusting settings, setting daily targets/stops, trailing drawdowns, and specifying trading hours/days. Advanced features include the “Use Auto Optimised Feature”, which allows dynamic optimization of settings automatically pushed to the active strategy.

Users can choose from up to 10 templates with custom instrument and bar type settings, which can be loaded by following instructions given in a weekly-updated Document. The strategy setup process takes about a minute in real-time, involving the loading of the chosen template, adjusting the chart, enabling the strategy, and pressing Start.

Some settings controlled by the “Use Auto Optimised Feature” include various specific trade signals, Tick Delay, Target/Stop Ticks, trading start/end times, which days to trade, and update frequency.

When the “Use Auto Optimised Feature” is selected, users can control some settings. These include the position of strategy buttons, label color background, daily profit/stop target values, trailing drawdown usage and trade size. However, some of these adjustments (like changing trade size) are not recommended for this specific strategy.

When running the strategy through the Strategy Analyzer yourself, everything opens up to you and you are able to fully customize it to your preferred instrument. Use the Strategy Analyzer to optimize this strategy, we ALWAYS include commission and Slippage (unlike the con-artists who exclude these).

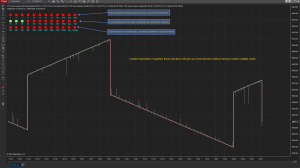

DTB Analytical Strategy 1 – MICROS (fully automated)

This Analytical Strategy is for the MICROS, shown above trading 9-11am ONLY as an option, specifically designed for DTB Bars, though they also work effectively with Volume, Tick, Range, and Renko bars. However, these strategies are incompatible with Time-based bars. Use the Strategy Analyzer to optimize this strategy, we ALWAYS include commission and Slippage (unlike the con-artists who exclude these). Micro Contracts are optimized in this strategy.

Using the Strategy Analyzer can increase the odds of success as it identifies effective settings. Regular optimization helps us keep pace with the current market’s rhythm or as I like to call it, the “heartbeat” of the market. This is a “Multi Entry” strategy designed for a minimum account balance of $2000. You can enter up to 4 positions at a time with selective trade size for entry as well as stop and target ticks for each entry, the strategy buttons display all this information along with the amount of positions selected to trade. Use the Strategy Analyzer to optimize this strategy, we ALWAYS include commission and Slippage (unlike the con-artists who exclude these).

Basic features include chart buttons/sliders for adjusting settings, daily targets/stops in dollars, trailing drawdown, and adjustable trading hours/days.

Advanced features include the “Use Auto Optimised Feature,” which enables dynamic strategy optimization. Settings are auto-adjusted and pushed to the active strategy on a trading chart. You can choose from up to 10 templates within the strategy settings, each with custom instruments and bar types. It’s crucial to read the associated document to select the template for your trading session.

Using the “Auto Optimised Feature” is a very simple way to start with this strategy, with resounding success, check the template document, choose your template, set up the chart, and load the corresponding template. After that, enable the strategy and start – that’s it!.

The “Use Auto Optimised Feature” controls several settings, including time & sales, buy-sell pressure, support and resistance settings, tick delay, trading signals, entry taking, stop/target ticks values, trading times, trading days, and strategy updating frequency.

Meanwhile, you can control several other settings, like the position of strategy buttons, label color background, trade sizes, daily profit target USD, daily stop loss USD, use of daily profit target, use of daily stop loss, use of trailing drawdown, and trailing drawdown $ value. Some settings are optimized and saved in the template but can still be user-adjusted. However, it is not recommended to adjust settings that have been optimized. Again, this is a multi entry strategy with an incredible success rate!

DTB Analytical Strategy 1 – MINIS (fully automated)

This Analytical Strategy is for the MINIS (same features as MICROS above but separated here for ease of use – button colors and button description ensures no mix up), specifically designed for DTB Bars, though they also work effectively with Volume, Tick, Range, and Renko bars. However, these strategies are incompatible with Time-based bars. Use the Strategy Analyzer to optimize this strategy, we ALWAYS include commission and Slippage (unlike the con-artists who exclude these). Mini Contracts are optimized in this strategy.

Using the Strategy Analyzer can increase the odds of success as it identifies effective settings. Regular optimization helps us keep pace with the current market’s rhythm or as I like to call it, the “heartbeat” of the market. This is a “Multi Entry” strategy designed for a minimum account balance of $20000. You can enter up to 4 positions at a time with selective trade size for entry as well as stop and target ticks for each entry, the strategy buttons display all this information along with the amount of positions selected to trade.

Basic features include chart buttons/sliders for adjusting settings, daily targets/stops in dollars, trailing drawdown, and adjustable trading hours/days.

Advanced features include the “Use Auto Optimised Feature,” which enables dynamic strategy optimization. Settings are auto-adjusted and pushed to the active strategy on a trading chart. You can choose from up to 10 templates within the strategy settings, each with custom instruments and bar types. It’s crucial to read the associated document to select the template for your trading session.

Using the “Auto Optimised Feature” is a very simple way to start with this strategy, with resounding success, check the template document, choose your template, set up the chart, and load the corresponding template. After that, enable the strategy and start – that’s it!.

The “Use Auto Optimised Feature” controls several settings, including time & sales, buy-sell pressure, support and resistance settings, tick delay, trading signals, entry taking, stop/target ticks values, trading times, trading days, and strategy updating frequency.

Meanwhile, you can control several other settings, like the position of strategy buttons, label color background, trade sizes, daily profit target USD, daily stop loss USD, use of daily profit target, use of daily stop loss, use of trailing drawdown, and trailing drawdown $ value. Some settings are optimized and saved in the template but can still be user-adjusted. However, it is not recommended to adjust settings that have been optimized. Again, this is a multi entry strategy with an incredible success rate!

All the tools on this page are included in your Membership - no more purchasing individual bits and pieces - welcome to the COMPLETE & ONLY System for NinjaTrader you will ever need!

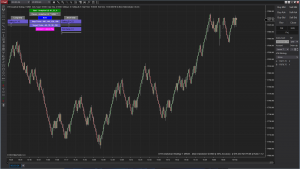

Chart Templates – Manual Trading Setups – Signal Chart Combos

As a DTB Traders member, you get a full set of tools with your subscription. The good thing about our system is that all the tools work well together. They’re not just random pieces, but a whole system that’s easy to use with an installation file. This file puts everything where it needs to be, so you can load a chart or strategy template and see what it does right away. You don’t need to fiddle with settings or figure out which indicators go with others. Everything you need to understand the market is right there, clear and easy to use.

We also have training documents to help you get started. The best part is you get to “earn while you learn”, because our templates are tested and efficient, providing a clear picture of what price is doing and what it may do next.

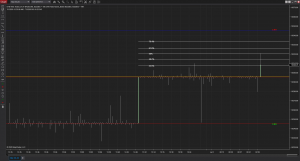

Looking at the above screenshot, you will notice a combination of indicators, these form part of a chart template called “Signal Chart Combo 5 Show me the Money DTBTT00” and is immediately available when you right click on the chart and load it up!

This is 1 of 7 templates that are part of the System, some have slightly different coloring and some trade different bar types, like the Trending or Flat baseline charts, they also provide a very simplistic way to read price. See some examples below of these Signal Charts:

DTB Auto Fibonacci Auto Trend Indicator

- Load on any or all your charts.

- Shows you current trend lines that can be used for support and resistance.

- Automatically draws the Fibonacci levels within the trend lines.

- Automatically adjusts as trend changes.

- Fully customizable to include any Fibonacci level or remove any level.

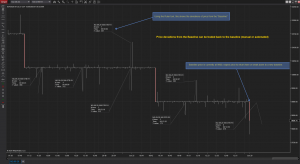

DTB Bars

- Can be used on any instrument.

- Designed to create baselines at key levels and show price deviations from those levels.

- Can be used for long term trading and short-term trading.

- Allows for automated and manual trading.

- Shows you price action without the noise common to minute / hourly bars.

- Can be modified to show a “Trending baseline” by inverting the parameters in Data Series.

DTB Cash Machine Indicator

- Shows areas where high volume has been pumped into the market in real time (tick by tick).

- Paints bars highlighted based on volume amount.

- Customizable volume caps based on session times.

- Tremendous amount of particularly useful information when understood.

- Shows current volume on top right.

- Current volume box color changes based on buy / sell pressure.

- Shows significant reversal points in real time.

- Not resource draining.

DTB Shadow Trading Indicator

- Can be used on any instrument and varying bar sizes.

- Designed to show you when price is likely to reverse (with great accuracy).

- Shows red bars and arrows when price is likely to fall, momentum line below price.

- Shows cyan bars and arrows when price is likely to rise, momentum line above price.

- Can be used for long term trading and short-term trading.

- A key indicator for taking manual trades or starting the automated strategy .

- Allows for a very small Stop Loss and large Profit Target.

- Overbought / Oversold parameters can be customized.

- Paints bars, all colors and settings are customizable.

DTB SI Indicator

- Stop Identifier indicator

- Determines areas where stops are being taken out based on trade secret variables.

- Paints arrows in real time based on price action and indicates direction price may move.

- Price will often retest these levels then run in the direction indicated (stop taking 101)

- Customizable to suit all market conditions and instruments.

DTB Trading Lines Indicator

- Load on any or all your charts.

- Displays the trading levels of the last 5 days: Low, high and close of 5 days ago, Low, high and close of 4 days ago, Low, high and close of 3 days ago. Low, high and close of 2 days ago. Low, high and close of 1 day ago, and Current high and low of day.

- Displays pivot points.

DTB Ultimate Bands Indicator

- Load on any or all your charts.

- Displays 4 bands with optional sound alerts for each band

- Great for trading price between the bands with small stop loss.

- Ideal for determining entries back to a baseline (when put alongside a baseline chart like a 175 / 1 or 1 / 175)

- Bar painting can be customized or removed.

DTB Wick Trader FLAT BASELINE Indicator

- Load on any or all of your flat baseline charts.

- Customizable values set to size of baseline.

- Can be used on all bar sizes on flat baseline charts.

- Displays Fibonacci levels between where baseline starts to where it ends.

- Ideal for longer term trading, set your entry with target and stop.

- Ideal for an indicator of when to activate the automated strategy, long or short.

- Add DTB Ticks Above_Below Indicator with this indicator to draw the baseline break point.

DTB Wick Trader TRENDING BASELINE Indicator

- Load on any or all of your flat baseline charts.

- Customizable values set to size of baseline.

- Can be used on all bar sizes on trending baseline charts.

- Displays Fibonacci levels between where baseline starts to where it would break.

- Ideal for longer term trading, set your entry with target and stop.

- Ideal for an indicator of when to activate the automated strategy, long or short.

DTB Trend Analysis Indicators

- All 3 are covered in this description, you can load them all together or one you choose.

- Load on any chart to see the larger / smaller trend for the Instrument.

- Contains 2 customizable boxes where you can select your own values.

- Trend Analysis of Minute bars as well as Day and Week trend.

- Trend Analysis of Tick bars, including Day and Week analysis.

- Trend Analysis of Volume bars, including Volume for Day and Week.

- Gives you the ability to monitor and react to overall trend.

DTB BreakOut Indicator

- Identifies a block of bars on the chart and the trend they start.

- Customizable to suit all market conditions and instruments.

- Plot colors can be modified

- Displays 3 box types:

1. Congestion (Gray), 2. Demand (LimeGreen) and 3. Supply (DeepPink).

This indicator will analyze the activity within a block period, extend it if the bars stay within a range and let you know once the range has been broken, displaying the trend that it ended on.

A congestion box (Gray) will show where price has failed to deliver and is followed by a continuation or reverse of trend.

DTB Pennants Indicator

- A pennant can be used as an entry pattern for the continuation of an established trend.

- Arrow plots on the break of the line.

- Bullish pennants can form after an uptrend, bearish pennants can form after a downtrend. The pattern has completed when price breaks out of the triangle in the direction of the preceding trend, at which point it will likely continue in this direction.

- Can be used on any chart and bar size.

- Automatically adjusts with price and constantly looks to plot the next trend.

- Customizable settings to adjust for size and length of trend.

- Insert 2 instances of this indicator to plot as shown (Example has a 5 and 10 value).

More from DTB Coming Soon

Not all the tools are listed in here and some are requiring updates which will be added as they become available.

Do not forget to register in our “Members area” if yo would like to take your trading to the next level!

If you’d like to see a feature from us in future or wish to add insight into a tool that already exists, let us know.

No catches. One easy subscription plan.

Don’t pay thousands of dollars for software you don’t use.

The DTB System is not only affordable but provides a complete set of tools that read the market and provide the absolute best trading opportunities that you will find with no other system.

We do not use outdated approaches with lagging indicators so we are confident that with some time spent evaluating the System, you will not look back!